Variation to Prohibited Burning Period - Extended 1 April - 14 April 2025

Due to seasonal conditions, the City of Wanneroo has extended its Prohibited Burning Period until 14 April 2025 inclusive. No Permits to burn will be issued prior to this date.

Budget 2024/25

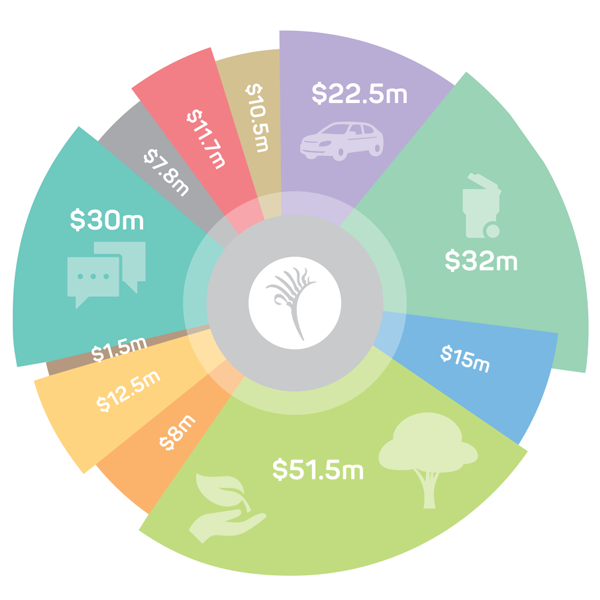

Budget overview

The City of Wanneroo’s 2024/25 budget will be invested in a range of services and facilities to keep our community connected, safe and sustainable.

It prioritises essential services and infrastructure projects while keeping rates as low as possible.

The budget pays for everyday community services and facilities we all use and supports a growing community that will be home to more than 367,000 people by 2041.

Rates help pay for new facilities, safe and efficient roads, vibrant and accessible parks and playgrounds, responsibly managed waste, community safety, and much more.

Read more about the 2024/25 budget.

Operational Expenditure

The below figures have been drawn from the City's 2024/25 operational expenditure budget. Numbers have been rounded for accessibility.

- Local roads and street lighting - $22.5m

- Waste services - $32m

- Governance - $15m

- Environment and sustainability - $51.5m

- Libraries, arts and culture - $8m

- Community recreation and facilities - $12.5m

- Economic development, advocacy and tourism - $1.5m

- Customer and information services - $30m

- Community development - $7.8m

- Planning and approval services, and public health - $11.7m

- Community safety and emergency management - $10.5m

Frequently Asked Questions

How does the City calculate its annual budget?

Our annual budget is calculated based on available funding sources for the financial year ahead, including:

- Grants

- Reserves

- Fees and charges

- Interest revenue

- Loans

- State and federal government funding

- Rates

We always aim to keep rate increases to a minimum, but as costs to keep the City running rise, modest rate increases are needed to support the growth and maintenance of our large City and keep services and facilities we all use every day running.

How does the City decide how to use the budget?

From major infrastructure projects to keeping our neighbourhoods clean, green and tidy, our budget provides free facilities and services we can all use every day.

Council is guided by a number of strategy documents such as the Strategic Community Plan, a 10-year plan developed in collaboration with residents, community groups and local business to ensure City expenditure is aligned with community priorities.

It also includes funding to support the success of our local sporting clubs, community groups, not-for-profit service providers and local businesses.

In developing our annual budget, we first review our operating costs, taking into account any external cost increases. For example, the State Government’s electricity tariff, which will increase by 12 per cent in 2023/24.

Some projects have to be undertaken to make sure we can meet our community’s needs and maintain a safe City for our residents and visitors, and we allocate funds for these essential services first.

We then review how we can implement efficiencies to help lower costs for other services and programs, such as reducing the frequency of mowing our parks in summer.

How does the City calculate the amount of rates income required?

Required rates income is determined by forecasting the amount of money needed for the infrastructure and many services and facilities our community relies on and expects.

City income is not generated through rates alone. A number of income streams keep our community running, including state and federal government funding, reserves, income generated from fees and charges and interest revenue.

Click below to learn more about rates and register for eRates:

How does the City calculate the amount I pay?

Not everyone pays the same amount in rates. Your annual rates are calculated by multiplying your property’s valuation (set by Landgate) by the differential rate in the dollar (set by Council). This is subject to a minimum payment, which is set each year by the City.

Your property valuation is determined by the Valuer General's Office at Landgate, a separate organisation to the City of Wanneroo. Landgate assigns non-rural properties, e.g. urban, residential and commercial, a Gross Rental Value (GRV), and land used for rural purposes an Unimproved Value (UV).

If your property valuation is higher or lower than your neighbour’s, your annual rates will be different.

Click below to learn more about rates and register for eRates:

How is my GRV calculated by Landgate?

GRV is the fair rental value your property might reasonably be expected to earn annually if it were rented.

When determining GRV of a residential property, Landgate considers several property attributes including location, age, building area and construction materials, number of bedrooms and bathrooms, and number of car shelters (garages/carports).

To find out more about GRV, visit landgate.wa.gov.au

When will the next valuation take place and how will my rates be impacted?

Under the revaluation cycle set by Landgate, Unimproved Value (UV) properties are valued annually and Gross Rental Values (GRV) are valued every three years.

Given the time it takes to determine the GRV for all properties, there is a delay between the date of valuation and when the GRV comes into effect (when the valuation can be applied to generate rates or charges). For local governments in the metropolitan area, this timeframe is 23 months.

City of Wanneroo GRV rated properties were last valued in August 2021. Those valuations were first applied to rates in the 2023/24 financial year.

UV rated properties in the City were revalued in 2022. Subsequent changes to property valuations in this category were applied for the 2023/24 financial year.

More information on property valuations is available on the Landgate website.

Will the revaluation increase my rates?

In most instances an increase in valuation will see rates increase, however when the City receives a revaluation, the rate in the dollar is adjusted to counteract some of the increase in the valuation.

As revaluations are City-wide, the City is unable to completely nullify the effect of an increase in valuation on individual properties. Through every revaluation there will be some properties where the rates increase and some decrease as a result of the adjusted rate in the dollar.

Can I object or appeal my property’s valuation?

Your valuation (GRV or UV) is only one factor used to calculate your rates notice. The Valuation of Land Act 1978 (as amended) Part IV sets out the manner in which valuation objections and appeals may be lodged.

A property owner may lodge an objection against the valuation of a property within 60 days of the date of issue of a rates notice.

For information on how your values are calculated and how to lodge an objection, please visit landgate.wa.gov.au/valuations or call Landgate Customer Service on +61 (08) 9273 7373.

Section 6.76 of the Local Government Act 1995 provides the grounds, time and the way individual objections and appeals to the Rates Record may be lodged. An objection to the Rate Book must be made in writing to the Council within 42 days of the date of issue of a rates notice.

Section 6.81 of the Local Government Act 1995 refers that rates assessments are required to be paid by the due date, irrespective of whether an objection or appeal has been lodged. In the event of a successful objection or appeal, the rates will be adjusted, and you will be advised accordingly. Credit balances may be refunded on request.

Reserve funds are typically created as long-term savings plans for future major expenditure that cannot be managed within a single budgetary year, but may also be required for other purposes.

Reserve funds negate or minimise the need for loan borrowings for such expenditures.

Specific rules that govern the circumstances under which reserve funds can be created, as well as how they are maintained and used.

See the City’s Financial Cash Backed Reserves Policy.

What reserve funds does the City have?

The City currently has 19 reserve funds.

See the City’s Long Term Financial Plan for a breakdown of these reserve funds.

Reserves allow the City to fully or partly fund specific projects. For example, the City expects to access $22m from the Regional Recreation Reserve to help deliver the highly anticipated Alkimos aquatic and recreation centre project for the community.

How does Council decide if a reserve fund is needed?

In line with the City’s Financial Cash Backed Reserves Policy, Council will generally support establishing a reserve for the reasons outlined by category below:

- To comply with legislative or other contractual requirements.

- Asset Reserves – to minimise impacts on the City’s operations in any one year from the expenditure of funds on asset purchases, or to set aside funds to cover major expenditure on assets in future years.

- Risk Mitigation and Strategic Opportunity Reserves – to minimise the impact on the City’s operations in any one year from unanticipated financial risks, and provide funds to take advantage of strategic opportunities that arise.

How does the City build up reserve funds?

Contributions are made to reserves from the operating Budget and other sources, such as grants and developer contributions.

Any interest earned on reserve balances goes into the fund that earned it.

Where can I find more information about City of Wanneroo reserves?

The City’s Financial Cash Backed Reserves Policy guides the establishment, maintenance and use of reserve funds.

The City’s Long Term Financial Plan provides oversight of the financial implications of decisions over the long-term and ensures the City has a financially sustainable future.